| | | 2016 PROXY STATEMENT |

| | VORNADO REALTY TRUST | | | | | | 29 | | |

COMPENSATION DISCUSSION AND ANALYSIS

Approach of this Compensation Discussion and Analysis Section This Compensation Discussion and Analysis, or "CD“CD&A,"” describes our executive compensation program for fiscal year 2015, certain elements of our 2016 program2023 and the executive paycompensation philosophy adhered toused by our Compensation Committee in making executive compensationto make decisions.

We use our executive compensation program to attract, retain and appropriately reward the members of our senior executive management team who lead our Company. In particular, thisteam. This CD&A explains how the Compensation Committee made 20152023 compensation decisions for our senior executive management team, including the following five named executive officers (the "Named“Named Executive Officers"Officers” or "NEOs"“NEOs”):n

•

Steven Roth, Chairman and Chief Executive Officer (our "CEO"“CEO”)

nStephen W. Theriot, Chief Financial Officer

nDavid R. Greenbaum, President, New York Division

n;

•

Michael J. Franco, Executive Vice President and Chief Investment Officer

nJoseph Macnow,Financial Officer;

•

Haim Chera, Executive Vice President—FinanceHead of Retail;

•

Barry S. Langer, Executive Vice President—Development and Administration, Chief Administrative OfficerBiographical information forCo-Head of Real Estate; and

•

Glen J. Weiss, Executive Vice President—Office Leasing and Co-Head of Real Estate.

These five individuals comprise our Named Executive Officers is availablesenior management team and are referred to in Part III to our Form 10-K forthis Proxy Statement as the year ended 2015, as filed with the SEC.“Senior Executives”. Under theSEC rules and regulations, of the SEC, each year the "Summary“Summary Compensation Table"Table” must disclosereport the salary paid and cash bonus earned during that year. ThisThat table also requires disclosure of all equity-based awards to be reported in the year granted, even if that year is different than the year such compensation was earned. Because thefor which a grant applies. We have historically granted annual incentive equity we grant in any one year is awarded in recognition of performance in the prior year, the SEC's approach requires that we disclose our equity awards granted in respect of 2014 performance on the 2015 line in the Summary Compensation Table. Although we believe the most appropriate disclosure of our executive compensation would combine the annual cash compensation paid in 2015 (for instance) with the equity-based compensation granted in 2016 for 2015 performance, the rules and regulations do not permit that. In other words, we grant our annual incentives and equity-based compensation and make our compensation decisions retrospectively—in the first quarter of a fiscalnew year for the actual performance of an executive in the just-then-completed priormost recently completed year. To more accurately present our compensation information in line with how ourwe make decisions are actually madeabout compensation (as described in more detail below under "—“—Comparison of 2013-20152021-2023 Total Direct Compensation"Direct/

Realizable Compensation”), the following discussion of compensation is with respect todiscusses both the annual incentivesalary and bonus paid with respect tofor a stated year combined withand the equity being granted in the following year for that year (if applicable). We also present (under “—Total Realized Compensation Table”), the closeactual compensation received for 2023, 2022, and 2021. We believe Total Realized Compensation is helpful in evaluating the effectiveness of the pay-for-performance alignment of our compensation program. Shareholder Engagement and Board Responsiveness

At our 2023 Annual Meeting of Shareholders, our say-on-pay proposal received the support of the holders of over 77% of Shares that applicable year after performance has been assessed.Executive Summary

Performance

During 2015,voted on the proposal. Since our 2023 Annual Meeting, we recorded strong financial results while continuingreached out to shareholders representing more than 70% of our simplificationoutstanding Shares (as of December 31, 2023) and focusing strategy.

nWe achieved 10.5% growthspoke with shareholders representing more than 50% of our outstanding Shares. Our Lead Independent Trustee participated in comparable funds from operations per diluted share.

nWe made significant progress implementingconversations with several of our simplificationlargest shareholders.

![[MISSING IMAGE: pc_contact-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-045234/pc_contact-pn.jpg)

In addition to our ESG-focused engagements and focus strategy by spinning offdiscussions in the ordinary course of business, we engaged directly with our strip shopping centersinvestors in various forums including at the BofA 2023 Global Real Estate Conference and malls business into Urban Edge Properties (NYSE: UE) in January 2015 and by selling over $1 billion of non-core or non-strategic assets and by purchasing approximately $850 million of high-quality assets in New York City (including approximately $700 million in Manhattan).

the NAREIT REITweek NYC conference.

| | | | | | | | | | |

| | | 30 | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | | | 19 | | |

| | | 2024 PROXY STATEMENT | | | | | | | | |

OverviewTotal Direct/Realizable and Total Realized Compensation are calculated as described in this Compensation Discussion and Analysis section of

the Proxy Statement. 2023 Total Direct/Realizable Compensation

ApproachCertain key elementsincludes the June 2023 Awards discussed above.

2023 Business Highlights

During 2023 we made significant progress executing on our goals and positioning Vornado for future growth, accomplishing the following strategic initiatives:

•

We continued the redevelopment of THE PENN DISTRICT, positioning Vornado to capitalize on the enormous opportunity we have on the West Side of Manhattan, including:

◦

Completion of the redevelopment of PENN 1 (2.6 million square feet).

◦

Nearing completion of PENN 2 (1.8 million square feet as expanded), on top of Penn Station, New York’s main transportation hub—the largest rail hub in North America.

◦

Continued leasing of retail space at the newly expanded Long Island Rail Road Concourse.

◦

Completed demolition of Hotel Pennsylvania, with plans to develop a premier office tower on the site.

◦

Opened restaurants or finalized leases with leading food and beverage operators including Blue Ribbon Sushi & Steak, The Avra Group, Noho Hospitality’s Bar Primi, Sunday Hospitality, Roberta’s Pizza, Anita Gelato and Los Tacos No. 1.

◦

Finalized lease with LifeTime Fitness and Pickleball.

•

We and the Rudin family completed agreements with Citadel Enterprise Americas LLC (“Citadel”) and with an affiliate of Kenneth C. Griffin, Citadel’s Founder and CEO for a series of transactions relating to 350 Park Avenue and 40 East 52nd Street, including full building leases for both buildings and to potentially form a joint venture to build a new 1.7 million square foot office tower.

•

We entered a joint venture with Blackstone Inc. and Hudson Pacific Properties to develop Sunset Pier 94 Studios, a 266,000 square foot purpose-built studio campus on our overall approach to compensation are designed to:nProvide for an annual incentive award that is performance-based with a formulaic thresholdPier 94 in New York City.

•

We leased approximately 2.8 million square feet in 2023 (2.2 million square feet at share).

•

Financed/Refinanced $800 million of mortgage loans in 2023.

•

Entered into $1.2 billion of interest rate swap arrangements and a cap.

nSet a target$950 million 1% SOFR interest rate cap arrangement for our senior management team that 50%the 1290 Avenue of their equity compensation (other than grants subject to time-based vestingthe Americas mortgage loan.

•

Completed over $200 million of dispositions in lieu of cash bonus) should be2023, including several non-core retail properties and The Armory Show located in New York.

•

We (i) ranked #1 in the

form of performance-based equity awards.

nHave equity ownership guidelinesDiversified Office/Retail REITs in the USA in the Global Real Estate Sustainability Benchmark (“GRESB”), and received the “Green Star” distinction for senior managementthe eleventh consecutive year and our Trustees.

nProvideGRESB’s five star rating, (ii) received the Leader in the Light Award by the National Association for "double trigger" accelerationReal Estate Investment Trusts (“NAREIT”) for diversified REITs for the thirteenth time, and (iii) were recognized as an EPA ENERGY STAR Partner of the vestingYear with the distinction of any unvested equity awards in connection with a changehaving demonstrated nine years of control.As an indication of the positive response of our shareholders to our approach, at our 2015 Annual Meeting approximately 89% of the votes cast on our advisory vote on executive compensation were cast FOR our compensation program. Our Compensation Committee considered the results of the 2015 votes and has continued our compensation program design which it believes embodies shareholder-friendly practices.

sustained excellence.

| | | | | | | | | | |

| | | | | | | | | | | |

| | 20 | | | | VORNADO REALTY TRUST | | | | 2016 PROXY STATEMENT |

| | | | | | | | 31 | | |

Shareholder-Friendly AspectsExecutive Compensation Philosophy

Our compensation program is based on a pay-for-performance philosophy and is designed to incentivize executives to achieve financial and strategic goals that are aligned with the Company’s long-term business strategy and the creation of sustained, long-term value for our shareholders.

The objectives of the Current Program| | | |

WHAT WE DO

| | WHAT WE DON'T DO

|

|---|

| RETAIN a highly experienced, “best-in-class” team of executives who have worked together as a team for a long period of time and who make major contributions to our success. | |

üPay for Performance. We place a heavy emphasis on performance-based compensation. Our | ATTRACT other highly qualified executives to strengthen that team as needed. | |

| | MOTIVATE our executives to contribute to the achievement of company-wide and business-unit goals as well as to pursue individual goals. | |

| | EMPHASIZE equity-based incentives with long-term performance measurement periods and vesting conditions. | |

| | ALIGN the interests of executives with shareholders by linking payouts under annual bonus plan is formula-driven. Bothincentives to performance measures that promote the minimumcreation of long-term shareholder value. | |

| | ACHIEVE an appropriate balance between risk and maximum amountreward in our compensation programs that may be funded is derived directly from specified quantifications of our Comparable FFO (as defined below) performance. Our annual equity grants are significantly tied to rigorous absolute and relative TSR-performance goals. | | ØNo Golden Parachute for our CEO. Mr. Steven Roth, our CEO, does not have any contractual severance arrangement with the Company. |

üEquity Ownership Guidelines. We require our CEO, other Named Executive Officers and our Trustees to hold equity in the Company equal to 6x, 3x and 5x, respectively, their annual base salaryencourage excessive or retainer.inappropriate risk-taking. |

|

ØNo Gross-Ups for Excess Parachute Payments. We have never had any arrangements requiring us to gross-up compensation to cover taxes owed by executives. |

üDouble Trigger Equity Acceleration Upon Change-of-Control. We require a "double trigger" for acceleration of vesting of outstanding grants following a change of control. |

|

ØLimited Retirement Benefits. We do not maintain a pension plan. Executives participate in a 401(k) plan and also may participate in an elective deferral plan with no match. |

üIndependent Compensation Consultant. Our Compensation Committee uses the consulting firm of Towers Watson (now Willis Towers Watson) and has determined it is independent. |

|

ØNo Excess Perquisites. We have no supplemental executive retirement plans, club memberships or other significant perquisites other than the use of a company car and driver. |

üCompensation Risk Assessment. We conduct an annual compensation risk assessment. |

|

ØNo Repricing of Options. Our 2010 Omnibus Share Plan does not permit the repricing of options without shareholder approval. Vornado has never repriced options. |

üClawbacks. We can recover performance-based cash and equity incentive compensation paid to executives in various circumstances. |

|

ØNo Hedging or Pledging. Our Trustees and senior executives are prohibited from hedging or engaging in any derivatives trading with respect to Company Shares and none of our Trustees or senior executives has any pledge of their Shares. |

ObjectivesThe following shows the 2023 pay mix for our CEO. 76% of Our Executivehis Total Direct/Realizable 2023 Compensation ProgramWe believe that the quality, skills and dedication of our Named Executive Officers are critical factors that affect the long-term value of the Company. Accordingly, one of the fundamental objectives of our Compensation Committee is to ensure we provide a comprehensive compensation program that aids us in our efforts to attract, retain and appropriately reward a "best-in-class" executive management team. Such a program is critical to our achieving continued success in the highly-competitive commercial real estate industry. To better align the interests of our executive officers with those of our shareholders in a pay-for-performance setting, a significant portion of each executive's total compensation is variable through a combination of performance-based, short- and long-term incentives, which are described in more detail below.

In sum, the objectives of our executive compensation program are to:

nRetain a highly-experienced, "best-in-class" team of executives who have worked together as a team for a long period of time and who make major contributionssubject to our success.

nAttract other highly-qualified executives to strengthen that team as needed.

Company performance.

| | | | | | | | | | |

| | | 32 | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | |

| | 2024 PROXY STATEMENT | | 21 | | |

The following graphic summarizes the performance periods and outcomes for our recent performance-based equity grants. The performance hurdles for the OPP awards granted in each of 2015, 2016, 2017, 2018 and 2020 and the Performance AO LTIP awards granted in 2019 did not meet the applicable performance condition and accordingly each of those awards were forfeited in their entirety. The 2022 and 2023 performance program lines below show the performance of our regular 2022 LTPP and 2023 LTPP programs, respectively, and do not include the Performance AO LTIPs granted as part of the June 2023 Awards. For purposes of the table below, we measure the Company’s absolute and relative performance under the 2022 and 2023 LTPPs as of December 31, 2023, though the actual number of units that will be earned will depend on actual performance through the end of the applicable measurement period. The “required price to begin earning” set forth below represents the adjusted Share price after reflecting adjustments for the Company’s spin-offs of Urban Edge and JBG Smith.

![[MISSING IMAGE: tbl_performance-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-045234/tbl_performance-pn.jpg)

Our Performance AO LTIP Units granted in 2019 included a performance condition requiring that our Share price close 10% above the strike price of $62.62 for 20 consecutive trading days before January 14, 2023. The performance condition was not met and consequently the units were forfeited.

Our 2020 OPP Plan provided participants the opportunity to earn equity awards if Vornado achieved certain absolute total shareholder returns and/or outperformed a benchmark weighted index consisting of other office and retail real estate companies. As of March 30, 2023, the end of the 2020 OPP measurement period, Vornado’s total shareholder return over the measurement period was -52.08% compared to a -8.60% return for the benchmark weighted index during such period and accordingly all awards under the 2020 OPP Plan were forfeited in their entirety.

Our 2021 OPP Plan provides participants the opportunity to earn equity awards if Vornado achieves certain absolute total shareholder returns and/or outperforms a benchmark weighted index consisting of other office and retail real estate companies. As of March 31, 2024, Vornado’s total shareholder return over the measurement period was -7.53% compared to a -4.99% return for the weighted index during such period.

Compensation Components

Our Named Executive Officers’ compensation currently has four primary components:

•

annual base salary, which includes cash payments and/or equity in lieu thereof;

•

annual incentive award, which includes cash payments and/or equity in lieu thereof;

•

long-term equity incentive, which includes restricted units and long-term incentive performance awards; and

•

development fee pool allocations.

| | | VORNADO REALTY TRUST | | | | 33 | | |

nMotivateThe overall compensation levels and allocation among these components, excluding any development fee pool allocations, are determined annually by our executives to contribute toCompensation Committee considering the achievementCompany’s performance during the year and a review of company-wide and business-unit goals as well as pursue individual goals.

nEmphasize equity-based incentives with long-term performance measurement periods and vesting conditions.

nAlignthe interestscompetitive market for executive talent. Historically, most of executives with shareholders by linking payouts under annual incentives to performance measures that promote the creation of long-term shareholder value.

nAchieve an appropriate balance between risk and reward in ourtotal compensation programs that does not encourage excessive or inappropriate risk-taking.Our executive compensation program is intended to reward the achievement of annual, long-term and strategic goals of both the Company and the individual executive. In order to achieve these intentions, our executive compensation program includes both fixed and variable components, as well as annual and long-term components, as described below. In particular, for our Chairman and CEO a majority of his compensation has been provided in long-term equity awards. These longer-term, equity-based awards reflect the form of equity compensation subjectCompensation Committee’s desire to multi-year TSR performance (OPP units) and/or time-based vesting provisions designed to ensure that the value of his compensation ultimately realized is based on our share price performance, further aligning his interests with those of the Company and its shareholders.

We believe the effectiveness of our compensation program in creating alignment ofdirectly align management and shareholder interests has contributedand to provide incentives to successfully implement our long-term performance, as evidenced bystrategic objectives.

The compensation program for our TSR forSenior Executives is described in the 10-year period through 2015 of 92.9%, which outperformedtable below.

| | PAY ELEMENT | | | | COMPENSATION TYPE | | | | OBJECTIVE AND KEY FEATURES | |

| | Base Salary | | | | Cash | | | | Objective: To provide appropriate fixed compensation that will promote executive retention and recruitment. Key Features/Actions: •

Fixed Compensation •

No more than $1,000,000 in salary •

No increases to NEO base salaries since 2018 and no increases to CEO base salary in over 20 years | |

| | Annual Incentive Awards | | | | Short-Term Variable Incentive Cash and/or Restricted Equity | | | | Objective: To reward the achievement of financial and operating objectives based on the Compensation Committee’s quantitative and qualitative assessment of the executive’s contributions. All or a portion of earned annual awards may be in restricted units to further align executive’s interests with shareholders. Key Features/Actions: •

Variable, short-term compensation awards •

Aggregate pool only funded upon the achievement of a threshold level of FFO, as adjusted, a key operating metric in the REIT industry •

Aggregate pool capped at 1.75% of FFO, as adjusted •

Allocated based on objective and subjective Company, business unit and individual performance •

Committee can decide to pay out less than the full amount of the funded pool and aggregate 2023 annual incentive awards to Senior Executives was only 1.36% of FFO, as adjusted | |

| | Annual Restricted Equity Grants | | | | Long-Term Variable Incentive Equity | | | | Objective: To align executive and shareholder interests, promote retention with multi-year vesting and provide stable long-term compensation. Key Features/Actions: •

Aligns executive and shareholder interests •

Vest ratably over four years •

Subject to a two-year holding period (regardless of vesting) and a “book-up” event (typically an increase in Share price) to have value | |

| | | 34 | | | | VORNADO REALTY TRUST | | |

| | Long-Term Performance Plan (Awarded in 2023 for 2022 performance) | | | | Long-Term Variable Incentive At-Risk Equity | | | | Objective: To enhance the pay-for-performance structure and shareholder alignment, while motivating and rewarding senior management for earnings growth and progress on ESG matters as well as for sustained TSR performance based on rigorous operational, absolute and relative hurdles. Key Features/Actions of LTPPs: •

Performance-based equity awards that can be earned based on (i) achievement of certain operational measures (50%) and (ii) relative TSR (50%), in each case with an applicable absolute modifier •

Only provides value to our executives upon the creation of meaningful shareholder value above specified hurdles over applicable performance periods •

Operational measures of FFO per share, as adjusted, and ESG metrics measuring greenhouse emissions reductions, GRESB score and LEED achievements •

50% of the earned payouts vest three years following grant and the remaining 50% vest four years following grant. Earned payouts are also subject to an additional one-year holding period following vesting, or in the case of our CEO, a three-year holding period | |

| | LTIPs (awarded in June 2023) | | | | Long-Term Variable Incentive Equity | | | | Objective: To align executive and shareholder interests and promote retention, with back-ended vesting. Key Features/Actions: •

Aligns executive and shareholder interests •

Vest in two equal installments on each of the 3rd and 4th anniversary of grant date •

Subject to a two-year holding period (regardless of vesting) and a “book-up” event (typically an increase in Share price) to have value | |

| | Performance AO LTIP Units (awarded in June 2023) | | | | Long-Term Variable Incentive At-Risk Equity | | | | Objective: Designed to (1) enhance our pay-for-performance structure by requiring a meaningful and sustained Share price increase before awards have value and (2) motivating and rewarding employees for superior Share price performance. Key Features/Actions: •

Enhances pay-for-performance structure and shareholder alignment •

Motivates and rewards only in instance of superior Share price performance •

Awards only have value if there has been a sustained increase in the Company’s Share price •

Vest 20% on 3rd anniversary of grant date and 80% on 4th anniversary of grant date | |

| | Development Fee Pool | | | | Cash pool based on 40% of actual net development fees received by the Company from third parties | | | | Objective: To incentivize and reward employees for seeking and finding new opportunities to create shareholder value by raising third-party capital for development projects to diversify risk and enhance the Company’s economics, and for retention purposes. Key Features/Actions: •

Development Fee Pool only applies to fees paid by joint venture partners or other third parties to the Company but does not apply to wholly-owned Vornado developments or to any amount attributable to Vornado’s share of a payment made by a joint venture •

Only provides value to our executives upon the creation of meaningful value to the Company through the receipt of development fees from third parties | |

| | | VORNADO REALTY TRUST | | | | 35 | | |

Pay Mix

We believe that the executive team’s compensation should be tied to Company goals. 76% of the FTSE NAREIT Office Index ("Office REIT") of 68.0% over the same time period. In addition, our TSR for 2015, was –3.9%Chief Executive Officer’s 2023 compensation and was 36.4% for 2014 while that71% of the Office REIT was 0.3% for 2015other NEOs’ average 2023 compensation is variable incentive pay. Approximately 45% of our Chief Executive Officer’s 2023 compensation and 25.9% for 2014. For 2015, we have kept flat our CEO's base compensation, cash incentive and the grant date value of restricted equity awards (as reflected in the "Total Direct Compensation Table" in this proxy statement). In addition, the total dollar value42% of the long-term incentive award potentially earnable ("Notional Amount") for our CEO (and our other Named Executed Officers) was also kept flat for 2015. When makingNEOs’ 2023 compensation decisions, we useis dependent on the Notional Amountachievement of OPP awards as oneobjective performance criteria. The charts below reflect the pay mix of the guideposts for year-over-year changes. We made changes to the terms of the 2016 OPP awards for 2015 performance to conform more closely to the standards for such plans adopted by other companies, including our peers. As a result of these changes, the accounting cost for a grant of the same Notional Amount of outperformance award increased by 26.3% from 2014 to 2015. Consequently, while the actual salaries, bonuses, value of restricted equity awards and the Notional Amounts of outperformance awards were unchanged between 2014 and 2015, the accounting cost for the aggregate compensation for our CEO and other Named Executive Officers increased by 10.7% and 6.0%, respectively, from 2014 to 2015. The larger increase in cost for our CEO as opposed to our other Named Executive Officers is due to the fact that a greater percentage of his compensation consists of OPP awards as opposed to other Named Executive Officers.NEOs, based on their 2023 Total Direct/Realizable Compensation.

![[MISSING IMAGE: pc_paymix-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-045234/pc_paymix-pn.jpg)

| | | 36 | | | | VORNADO REALTY TRUST | | |

How Pay Aligns with Performance2015

2023 Performance Metrics Considered For 20152023 compensation, among the subjective and objective factors considered both objectively and subjectively, were the changes in the Company's and the applicable division's operating and performanceCompany’s results during the year (Comparable EBITDA, Comparable(NOI at share and FFO, and FFO)as adjusted, among other financial results), our TSR for the year,leasing volume, development progress, financing activities, progress on ESG goals, and the factors mentioned below. Increases “NOI” (or decreases in pay and allocations for 2015, 2014 and 2013Net Operating Income) means total revenues less operating expenses including our share of various compensation elements to our Named Executive Officers were based, in part, upon the results of our review of these factors. EBITDA means earnings before interest, taxes, depreciation and amortization, Comparable EBITDA means EBITDA as adjusted to exclude discontinued operations and exclude non-comparable gains and losses including impairments. FFOpartially owned entities. “FFO” means funds from operations as defined by the National Association of Real Estate Investment Trusts (NAREIT). Comparable FFO (or CFFO)NAREIT. “FFO, as adjusted,” means FFO as adjusted to exclude non-comparable gains and losses, impairments and non-real estate-related items.certain items that impact the comparability of period-to-period FFO. Each of these metrics is providedare presented in our regular annual and quarterly reports as well aswith reconciliations to the most comparable metric presented in accordance with GAAP. Although they

| | | | | | | | | | |

| | | | | | | | | | |

| | 22 | | | | VORNADO REALTY TRUST | | | | 2016 PROXY STATEMENT |

| | | | | | | | | | |

are non-GAAP metrics, we use these metricsthem in making our compensation decisions because they facilitate meaningful comparisons in operating performance between periods and among our peers. TSR means our total shareholder return (including dividends) for a given period.

Key Year-Over-Year Comparisons

Our Comparable EBITDA, Comparable FFO, FFO and TSR for 2015, 20142023 was 39.2% while that of our NY REIT Peers (comprised of Empire State Realty Trust, Inc., Paramount Group, Inc. and 2013 are presented below.Metrics Considered

SL Green Realty Corp.) was 30.8% and that of the FTSE NAREIT Office Index was 2.0%. | | | | | | |

| | 2015

| | 2014

| | 2013

|

|---|

| | | | | | | |

Comparable EBITDA | | $1,533 million | | $1,447 million | | $1,387 million |

Comparable FFO | | $915 million | | $825 million | | $752 million |

FFO | | $1,039 million | | $911 million | | $641 million |

1-year TSR | | (3.9%) | | 36.4% | | 14.7% |

| | | | | | | |

In determining annual incentive and long-term equity compensation levels earned for 2015, our Compensation Committee sought to find a balance among (i) appropriately rewarding the significant operational achievements by the Company during the year, as highlighted above, (ii) ensuring annual incentive, long-term equity and total compensation levels were in line with the prevailing competitive market and adequate to address our recruitment and retention needs

We operate in a highly-competitivehighly competitive commercial real estate industry where we actively compete for business opportunities and executive talent. In determining compensation levels for 2023, our Compensation Committee did not attribute a numeric weight to any one factor, but sought to find a balance among (i) appropriately recognizing the significant operational and development achievements during the year, (ii) maintaining total compensation levels in line with the highly competitive market for executive talent and at a level adequate to address our recruitment and retention needs and (iii) maintaining a balanced compensation program designed to foster alignment of management and shareholder interests in a manner that reflectsconsistent with evolving market "best practices"“best practices” as well as views of our shareholders. No numerical weight is attributed to any one factor.Alignment of Pay with Performance

Our Compensation Committee made compensation decisions for 2015 in line with our pay-for-performance philosophy.

nBase salaries were maintained at 2014 levels to focus on the performance-oriented components of compensation.

nFor our CEO, approximately 57% of his equity grants were in the form of performance-based equity.

nFor our other NEOs, in the aggregate, approximately 57% of their equity grants (other than grants in lieu of cash bonus which are described in footnote (2) of the Summary Compensation Table) were in the form of performance-based equity.

| | | | | | | | | | |

| | | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | | | 23 | | |

| | | | | | | | | | |

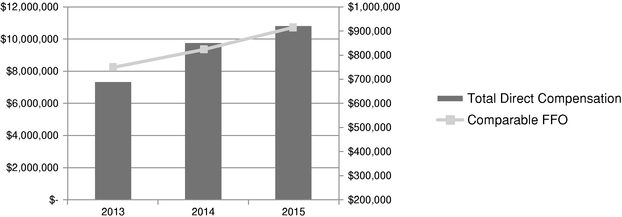

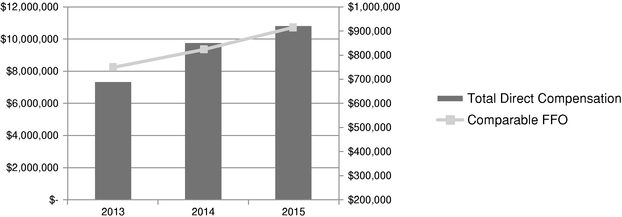

To demonstrate the alignment of our compensation philosophy with performance, the following chart illustrates how our CEO's Total Direct Compensation (as defined below under "—Comparison of 2013-2015 Total Direct Compensation") compares to our Comparable FFO for the applicable year.

(Comparable FFO in thousands)

To demonstrate how the mix of our executive pay is designed to align the executive's and shareholders' interests, the following charts show the mix of our CEO's and other NEOs' pay among cash, annual grants of time-vesting equity, equity in lieu of cash bonus and performance-based equity.

| | |

CEO Pay Mix (2015) | | Other NEO Pay Mix (2015) |

|

|

|

How We Determine Executive Compensation

Our Compensation Committee, comprised solely of independent Trustees, determines compensation for our Named Executive Officers and is comprised of three independent trustees, Michael Lynne (Chairman), Daniel R. Tisch and Dr. Richard R. West.other senior executives. Our Compensation Committee exercises independent judgment with respect toon executive compensation matters and administers our equity incentive programs, including reviewing and approving equity grants to our executives pursuant to our 2010under the 2023 Omnibus Share Plan.Plan (the “2023 Omnibus Plan”) and the 2019 Omnibus Share Plan (the “2019 Omnibus Plan” and, together with the 2023 Omnibus Plan, the “Omnibus Plans”). Our Compensation Committee operates under a written charter adopted by the Board, a copy of which is available on our website (www.vno.comwww.vno.com/governance/committee-charters).

| | | | | | | | | | |

| | | | | | | | | | |

| | 24 | | | | VORNADO REALTY TRUST | | | | 2016 PROXY STATEMENT |

| | | | | | | | | | |

We generally make our compensation decisions generally in the first quarter of a fiscal year. These decisions cover the prior yearyear’s performance and are based on the prior year's performance by the Company and/or division or functional area and applicable executive.contributions. In addition, in the first quarter of a fiscal year, we establish that year'syear’s performance threshold for our formula-based, short-term annual incentive program.

Our decisions on compensationprogram and in the first quarter of 2023 we also established the metrics and applicable threshold, targets and maximum levels for our Named Executive Officers2023 LTPP.

Our compensation decisions are based primarily upon our assessment of each executive'sexecutive’s leadership, operational performance and potential to enhance long-term shareholder value. For our CEO, this assessment is made by the Compensation Committee. For our other Named Executive Officers, this assessment is initially made by our CEO subject to the review and approval of the Compensation Committee. Our annual, short-term incentive program provides for a minimum performance threshold for, and a cap on, a bonus pool comprising the aggregate dollar value offor annual incentive awards we can make to our senior executive management team. We believe that this method, as opposed to an entirely formulaic method of determining compensation, provides us with the ability to adjust compensation based on a number of performance factors affecting an individual executive within a formulaic cap. It also has the added benefit of reducing the risk to the Company that could potentially be associated with entirely formulaic compensation decisions.Senior Executives. Key factors we consider when making annual compensation decisions include: actual performance compared to the financial, operational and strategic goals established for the Company or the executive'sexecutive’s operating division at the beginning of the year;division; the nature, scope and level of responsibilities; the contribution to the Company'sCompany’s financial and operational results, particularly with respect to keyon metrics such as Comparable EBITDA,NOI at share, FFO, Comparable FFO, as adjusted, TSR and TSRleasing activity for the year; and the executive's contribution to the Company'sCompany’s ESG efforts, including progress on our Vision 2030 Plan and other ESG goals; contribution to our substantial ongoing development projects; financing and investment activities; capital allocation; and contribution to the Company’s commitment to corporate responsibility, including success in creating a culture of unyielding integrity and compliance with applicable laws and our ethics policies. These factors may be considered on an absolute and/or relative basis with respect to other companies or indices.

| | | VORNADO REALTY TRUST | | | | 37 | | |

In determining individual pay levels, and opportunities, we also consider each executive's current salary and prior-year bonus (or annual incentive award), the value of an executive's equity stake in the Company, andexecutive’s historical compensation, the appropriate balance between incentives for long-term and short-term performance and the compensation paid to the executive'sexecutive’s peers within the Company. WeAs discussed below, we also consider competitive market compensation paid by other companies that operate in our business or that compete for the same talent pool, such as other S&P 500 REITs, other real estate companies operating in our core markets and, in some cases, private equity firms, investment banking firms and hedge fund and private equity firms.funds. However, we do not formulaically tie our compensation decisions to any particular range or level of total compensation paid to executives at these companies. Furthermore, we consider the actual Total Realized Compensation historically received by our management in determining whether our compensation program meets our goals of alignment with shareholder interests.

In addition, we encourage alignment with shareholders' interestsshareholders through long-term, equity-based compensation. We apportion cash payments and equity incentive awards as we think best in order to provide the appropriate incentives to meet our compensation objectives both individually and in the aggregate for executives and other employees. The factors we consider in evaluating compensation for any particular year may not be applicable to determinations in other years. Typically, our Chairman and CEO receives a higher proportion of his compensation in the form of equity than other Named Executive Officers who, in turn, receive a higher proportion of their compensation in the form of equity than our other employees. This allocation is based on (1) the relative seniority of the applicable executives and (2) a determination that the applicable executives should have a greater proportion of their compensation in a form that further aligns their interests with those of shareholders. We regularly review our compensation program to determine whether we have given the proper incentives to our Named Executive Officers to deliver superior performance on a cost-effective basis and for them to continue their careers with us.

Role of the Corporate Governance and Nominating Committee, the Compensation Committee, the Chairman and CEO The Corporate Governance and Nominating Committee of our Board is responsible for evaluating potential candidates for Chairman and CEO, and for overseeing the development of executive succession plans. The Compensation Committee of our Board (1) reviews and approves the compensation of our executive officers and other employees whose total cash compensation exceeds $200,000 per year, (2) oversees the administration and implementation of our incentive compensation and other equity-based awards, and (3) regularly evaluates the effectiveness of our overall executive compensation program.

| | | | | | | | | | |

| | | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | | | 25 | | |

| | | | | | | | | | |

As part of this responsibility, theThe Compensation Committee oversees the design, development and implementation of the compensation program for our Chairman and CEO and our other Named Executive Officers. The Compensation Committee evaluates theCEO performance of our Chairman and CEO and sets his compensation. Our Chairman and CEO and the Compensation Committee together assess the performance of our other senior executives and determineour Compensation Committee determines their compensation, based on the initial recommendations of our Chairman and CEO. The other Named Executive OfficersNEOs do not play a role in determining their own compensation, other than discussing individual performance objectives with our Chairman and CEO.

In support of these responsibilities, members of our senior executive management team, in conjunctionalong with other senior executives, have the initial responsibility of reviewing the performance of the employees reporting to him or herthem and recommending compensation actions for suchthose employees.This process involves multiple meetings among our Chairman and CEO, our

Role of Compensation Consultants/ Peer Group Benchmarking

The Compensation Committee has engaged the services of FTI Consulting, Inc. (“FTI Consulting”), as a compensation consultant, including for 2023 compensation. The Compensation Committee assessed the independence of FTI Consulting in accordance with the NYSE listing standards and our Compensation Committee's compensation consultants. Typically, in the third and fourth quartersconcluded that no conflict of each year, these parties meet to discuss and establish an overall level of compensation for the year and the base compensation for the following year. For 2015, as has been our historical practice, our Chairman and CEO obtained individual recommendationsinterest existed that would prevent FTI Consulting from division heads as to compensation levels for those persons reporting to the division heads. These recommendations are discussed among our Chairman and CEO and the division heads prior to a recommendation being presented toindependently advising the Compensation Committee. For our senior executive management team, other than our Chairman and CEO, recommendations are prepared based upon discussions among the Compensation Committee and our Chairman and CEO. These recommendations are based upon our objectives described above and may include factors such as information obtained from compensation consultants. Our Chairman and CEO discuss these recommendations with our other senior executives in one-on-one meetings. After these discussions, certain allocations or other aspects of compensation may be revised to some degree and the revised recommendations are presented to the Compensation Committee for discussion and review and, ultimately, through a continued process, approval. The compensation of our Chairman and CEO is determined in accordance with a similar process involving direct discussions among the Compensation Committee, our Chairman and CEO and the Compensation Committee's compensation consultants.Role of Compensation Consultants

Our Compensation Committee has retained Towers Watson & Co. ("Towers Watson") as its independent compensation consulting firm to provideis authorized by the Compensation Committee with relevant data concerning the marketplace and our peer group as well as its own independent analysis and recommendations concerning executive compensation. Towers Watson regularly participates in Compensation Committee meetings. Our Compensation Committee has the authorityBoard to set Towers Watson'sFTI Consulting’s compensation and to replace Towers WatsonFTI Consulting as its independent outside compensation consultant or hire additional consultants at any time. Towers Watson regularly participates in Compensation Committee meetings. In 2015, we paid Towers Watson approximately $139,000 in compensation-related fees. In addition, in 2016 Towers Watson merged with Willis Group and is now Willis Towers Watson Public Limited Company ("Willis Towers Watson"). Historically, the Willis Group has provided us with insurance-related services including services to our captive insurance company. In 2015, we paid the Willis Group (now Willis Towers Watson) approximately $923,000 in fees. In light of the acquisition of the Willis Group,

For 2023 compensation decisions, the Compensation Committee reviewed peer compensation information, prepared by FTI Consulting, in connection with its compensation decisions. This peer information was not used to target a particular percentile for our CEO’s 2023 compensation but rather to set an appropriate range of compensation, considering relative size, performance and competitive factors. FTI Consulting reviewed the Company’s 2022 peer group and assessed the independenceindustries, geographies, market capitalization, revenues, among other factors, of Willis Towers Watson pursuantthe peer group relative to SEC rules (including Item 407(e)(3)(iv)the Company and recommended removing two of Regulation S-K)the largest companies, by market capitalization, that were in the 2022 peer group and replacing them with two companies that are more similar in size to the NYSE listing standards and concluded that no conflict of interest exists that would prevent Willis Towers Watson from independently advising the Compensation Committee. In particular,Company.

Following FTI Consulting’s recommendation, the Compensation Committee considered a presentation it received from Willis Towers Watson that described Willis Towers Watson's policies and procedures to prevent or mitigate conflicts of interest. The Compensation Committee also reviewed and was satisfied that there was no business or personal relationships between members ofadopted the Compensation Committee and the individuals at Willis Towers Watson supporting the Compensation Committee. The Compensation Committee considered that Willis Towers Watson reports directly to the Chair of the Compensation Committee and that the Compensation Committee has the authority to set Willis Towers Watson's compensation and to replace Willis Towers Watson as its independent outside compensation consultant or hire additional consultants at any time. Finally, the Compensation Committee considered other

following peer group for 2023.

| | | | | | | | | | |

| | | 38 | | | | | | | | |

| | 26 | | | | VORNADO REALTY TRUST | | |

| | 20162024 PROXY STATEMENT |

| | | | | | | | | | |

factors relevant to Willis Towers Watson's independence from management, including all

Vornado’s Total Capitalization as of October 31, 2023 was slightly above the median of the factors set forthpeer group and close to the 75th percentile in the NYSE listing standards.For 2015 compensation decisions, Willis Towers Watson prepared, among other reports, an analysis of compensation levels and performance using the metrics described below at the following companies that it identified as peer companies within the context of the executive pay philosophy of the Compensation Committee: American Tower Corporation; Boston Properties, Inc.; CB Richard Ellis Group, Inc.; Equity Residential; General Growth Properties, Inc.; HCP, Inc.; Health Care REIT, Inc.; Host Hotels & Resorts, Inc.; Kimco Realty Corporation; ProLogis; Public Storage; Simon Property Group, Inc.; SL Green Realty Corp.; and Ventas, Inc. revenue.

Our Compensation Committee has elected to use the foregoing executive compensation peer group, asbecause the competitive landscape in which we compete for investment capital and executive talent is comprised of other publicly-traded REITs as well as real estate operating companies. Additionally, as many of our competitors in the markets in which we operate, particularly with respect to our New York division, are asset managersprivate equity and investment management firms not structured as REITs and private entities such as real estate opportunity funds, sovereign wealth funds and pension funds, among others, our Compensation Committee, from time to time, has also considered compensation levels and trends amongstamong our non-public competitors as obtained from surveys and other proprietary data sources. Consistent with prior years, the Compensation Committee reviewed and discussed the analyses prepared by Willis Towers Watson,FTI Consulting and determined that the analyses were useful in indicating that the compensation opportunities awarded to executive officers are in line with the prevailing competitive market. Furthermore, realized awards duly reflectTotal Realized Compensation metrics align with the performance of the Company and the shareholder value created.From time to time, the Company also engages the services of FTI Consulting, Inc., as a compensation consultant, to provide assistance with gathering and presenting third-party data used in determining industry-or market-specific results.

Analysis of Risk Associated with Our Executive Compensation Program Our Compensation Committee has discussed the concept of risk as it relates to our executive compensation program and the Compensation Committee does not believe our executive compensation program encourages excessive or inappropriate risk-taking for the reasons stated below. We structure our pay to consist of both fixed and variable compensation. The fixed portion (base salary) of compensation is designed to provide a base level of income regardless of our financial or shareShare price performance. The variable portionselements of compensation (cash incentive and equity) are designed to encourage and reward both short- and long-term corporate performance. For short-term performance, cashannual incentives are awarded based on the formulaic fundingthresholds of our annual incentive pool and assessments of performance during the prior year. For long-term performance, our options, restricted shares, restricted units, awards under our outperformance plans ("OPP") and other equity awards generally vest over three, four or five years and onlyyears. Awards of LTPP Units, OPP Units, Performance AO LTIP Units, appreciation-only OP units (“AO LTIP Units”) or options have value (inonly if our Share price increases over time (and, in the case of awards such as options,LTPP Units, if we meet specified operational goals). Awards of restricted units or OPP awards) orcan be redeemed for Shares only increase in value (in the case of awards such as restricted shares) if our Share price increases over time. Furthermore, with regard to grantsAwards of restricted units require a two-year holding period (regardless of vesting). For LTPP and OPP awards, made since 2013, we require members of senior managementour Named Executive Officers to hold the equity received with respect toon earned and vested awards for one additional year after they have vested. We believe that these variable elementsvested (or three years, in the case of compensation are a sufficient percentage of total compensation to provide incentives to executives to produce superior short- and long-term corporate results, whileour CEO for the fixed element is also sufficiently high that the executives are not encouraged to take unnecessary or excessive risks in doing so.LTPP). We and our Compensation Committee also believe that the mix of formulaic criteria and a non-formulaic evaluation of historic performance provides an incentive for our executives to produce superior performance without the distorting effects of providing a pre-determinable compensation award based on the performance of only one division or business unit or upon other results that may not reflect the long- or short-term results of the Company as a whole.

result in long-term value creation. | | | | | | | | | | |

| | | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | | | 27 | | |

| | | | | | | | | | |

As demonstrated above, our executive compensation program is structured to achieve its objectives by (i) providing incentives to our Named Executive Officers to manage the Company for the creation of long-term, shareholder value, (ii) avoiding the type of disproportionately large, short-term incentives that could encourage our Named Executive Officers to takethe taking of excessive risks that may not be in the Company'sor sacrificing long-term interests,value, (iii) requiring our Named Executive Officersexecutives to maintain a significant investment in the Company and (iv) evaluating annually an array of performance criteria in determining executive compensation rather than focusing on a singular metric that may encourage unnecessary risk-taking. We believe thisThis combination of factors encourages our Named Executive Officersexecutives to manage the Company prudently.

Elements of Our Compensation Program

Our Named Executive Officers' compensation currently has three primary components:

nannual base salary;

nannual incentive awards, which include cash payments and/or awards of equity; and

nlong-term equity incentives, which may include restricted units, stock options and long-term incentive performance unit awards such as those awarded under our OPP.

The overall levels of compensation and the allocation among these components are determined annually by our Compensation Committee based upon an analysis of the Company's performance during the year and a review of the prevailing competitive market for executive talent in which we operate. Historically, a substantial majority of the total compensation for our CEO has been in the form of long-term equity awards, including performance-based awards subject to relative performance thresholds such as those awarded under our OPP. These longer-term awards further the Compensation Committee's desire to directly align management and shareholder interests and to provide incentives for each executive to successfully implement our long-term strategic goals.

| | | | | | | | | | |

| | | | | | | | | | | |

| | 28 | | | | VORNADO REALTY TRUST | | | | 2016 PROXY STATEMENT |

| | | | | | | | 39 | | |

The components of our compensation program for our senior management can be described as shown in the chart below. As noted below,each component of compensation has been capped.

| | | | |

| | | | |

| | | | |

| | Objectives | | Key Features |

| | | | |

Base Salary | | n

Provide an appropriate level of fixed compensation that will promote executive retention and recruitment.

| | n

Fixed compensation.

n

No executive receives in excess of $1,000,000 of salary.

|

| | | | |

Annual Incentive Awards | | n

Reward achievement of financial and operating goals for a year based on the Compensation Committee's quantitative and qualitative assessment of the executive's contributions to that performance.

n

Typically provide that a portion of such award be in the form of restricted equity to further align an executive's interests with that of shareholders.

| | n

Variable, short-term cash compensation and time-based equity awards.

n

Funded upon the achievement of a threshold CFFO level.

n

Aggregate pool capped at 1.25% of CFFO.

n

Allocated based on objective and subjective Company, business unit and individual performance.

n

Committee can decide to pay out less than the full amount of the funded pool

|

| | | | |

Annual Restricted Equity Grants | | n

Align the interests of our executives with those of our shareholders.

n

Promote the retention of executives with multi-year vesting.

n

Provide stable long-term compensation as a balance to a risk-taking approach.

| | n

Equity awards that vest ratably over four years.

n

Awards are capped by the awards available to be issued under our Omnibus Share Plan.

n

Members of senior management receive Restricted Units which require a two-year holding period (regardless of vesting) and a "book-up" event (typically an increase in Share price) to have value.

|

| | | | |

Performance-Based, Long-Term Incentive Program | | n

Promote the creation of long-term shareholder value as the awards will only have value if an appropriate TSR is achieved.

n

Align the interests of our executives with those of our shareholders.

n

Promote the retention of executives with awards that are subject to multi-year vesting after they are earned.

| | n

Variable, performance-based long-term equity compensation.

n

Amount is earned based on a three-year period of absolute and relative TSR performance.

n

Vests over three years once (and if) they are earned.

n

Award capped on value of a fixed number of units and availability under our Omnibus Share Plan.

|

| | | 2024 PROXY STATEMENT | |

Elements of Our Compensation Program

Base salaries for our Named Executive Officers are established based on the scope of their responsibilities, taking into account the competitive market compensation paid by other companies for similar positions as well as salaries paid to the executives'of peers within the Company and any applicable employment agreement. In

| | | | | | | | | | |

| | | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | | | 29 | | |

| | | | | | | | | | |

accordanceCompany. Consistent with our pay-for-performance philosophy, we structure an executive's annual base salary to beis a relatively low percentage of total compensation. ThereExcluding temporary salary reductions implemented during 2020 due to the impact of the COVID-19 pandemic on our business, there were no increases in our Named Executive Officers'Officers’ base salary levels for 2015 over those of 2014, nor2023 and there have therenot been any increases in our NamedChief Executive Officers'Officer’s base salary levels for the past severalin over 20 years.

Our Compensation Committee has established an annuala short-term incentive program for the senior executive management team that formulaically ties a maximum award pool to achieving a Comparablelevel of FFO, performance threshold.as adjusted, of at least 65% of the prior year, and set a cap for the aggregate pool of bonuses to the Senior Executives at 1.75% of FFO, as adjusted. The Company views and, we believe our shareholders view, Comparablebelieves FFO, as adjusted, is one of the key operating metrics within the REIT industry and we believe, a primary driver of long-term TSR performance. We use FFO, as adjusted, as the primary metric for our annual incentive awards rather than total FFO. FFO, as adjusted, excludes certain items that impact the comparability of period-to-period FFO, and thus the Compensation Committee believes it provides a better metric than total FFO for assessing management’s performance. Under our annual compensation program, members of our senior executive management team, including all of our Named Executive Officers, will have the ability toparticipants may earn annual cash incentive payments and/or equity awards if and only if the Company achieves Comparable FFO, ofas adjusted, is at least 80%65% or more of the prior year's Comparable FFO. In the event that the Company fails to achieve Comparableyear’s comparable FFO, of 80% or more of the prior year's Comparable FFO, no incentive payments would be earned or paid under the program.as adjusted. Moreover, even if the Company does achieve the stipulated Comparable FFO, as adjusted, performance requirement, under the annual incentive program, the Compensation Committee always retains the right, consistent with best practices, to elect to reduce or make no payments under the program. Our

For 2023, the maximum pool available for annual incentive bonuses to Senior Executives was $9.5 million (1.75% of FFO, as adjusted) but nevertheless, due to our relative performance, our Compensation Committee has electedgranted a reduced aggregate amount of $7.5 million in annual bonuses to use ComparableSenior Executives, equal to 1.36% of FFO, as the primary metric for our annual incentive award rather than total FFO. Comparable FFO excludes the impact of certain non-recurring items such as income or loss from discontinued operations, the sale or mark-to-market of marketable securities or derivatives and early extinguishment of debt, restructuring costs and non-cash impairment losses, among others, and thus theadjusted.

As described in more detail below under “—Current Year Compensation Committee believes it provides a better metric than total FFO for assessing management's performance for the year.Aggregate incentive awards earned under the annual short-term incentive program by our senior executive management team are subject to a cap of 1.25% of Comparable FFO earned by the Company for the year, withDecisions”, individual award allocations under the programare determined by the Compensation Committee based on an assessment of individual and overallCompany performance. Performance criteria evaluated by the Compensation Committeeused when determining individual incentive awards under the annual incentive program, assuming the Company has achieved the required Comparable FFO performance threshold necessary for our senior executive management team to be eligible to earn incentive awards under the program, will include, among others, the following:

nTSR, both on an absolute basis and relative to the performance of the peer group and the REIT industry;

n

•

Leasing performance and occupancy levels;

n

•

Execution of our development and redevelopment projects;

•

Capital markets performance and maintenance of a strong balance sheet;

n

•

Acquisitions, dispositions and financing activity;

•

Same store EBITDA;

nNOI at share;

•

FFO and FFO, as adjusted;

•

Implementation and achievement of goals, including expense control and adherence to budget;budget, and

n ESG initiatives, including sustainability goals; and

•

Achievement of business unit and/or departmental objectives.

Any awards

earned under the annual incentive program are payable in cash and/or equity awards, generally in the first quarter of each year for the prior

year'syear’s performance.

Long-Term Equity Incentives

Compensation is typically awarded to our Named Executive Officers in the form of long-term equity incentives issued under our 2010 Omnibus Share Plan (as may be amended, the "2010 Plan") through performance-based equity awards such as those that may be earned under our OPP and future out-performance plans, grants of stock options and restricted units. The granting of equity awards links a Named Executive Officer's

| | | | | | | | | | |

| | | | 40 | | | | | | |

| | 30 | | | | VORNADO REALTY TRUST | | |

| | 20162024 PROXY STATEMENT |

| | | | | | | | | | |

Long-Term Equity Incentives

Long-term equity compensation is typically issued under our Omnibus Plans through performance-based awards, such as our LTPP Units (awarded in 2023 for 2022 performance), or Performance AO LTIP Units (awarded in June 2023), and grants of time-based restricted units. Equity awards link compensation directly to the performance of our Share price. We believe this encourages our NEOs to make business decisions with an ownership mentality.OPP Awards. Our OPP has beenNEOs were awarded LTPP Units and time-based restricted LTIP units in January 2023 on an approximately 50/50 basis for 2022 performance. Other employees received awards of time-based restricted units for 2022 performance. Our NEOs and a broad group of employees also received Performance AO LTIP Units and time-based restricted units in June 2023. Our LTPP program and June 2023 grants were developed with the guidance and input of FTI Consulting Inc. (a(the Compensation Committee’s independent compensation consultant retained by the Company) and Willis Towers Watson. Changes made in 2016consultant).

Description of Awards

2023 LTPP

In January 2023 we granted LTPP Units to our OPP wereSenior Executives with respect to 2022 performance. 50% of the LTPP Units may be earned based on advice of FTI Consulting, Inc. with the concurrence of Willis Towers Watson. These performance-based awards are earnedour relative TSR performance over a three-year period whichending in January 2026 and 50% may be earned based on the achievement of specified operating/ESG performance measures over a one-year period ending December 31, 2023, in each case with further modifiers based on the Company’s absolute TSR over a three-year period.

The relative TSR portion of the LTPP is then followed by back-end vesting requirements (during years three, fourequally bifurcated based on our performance relative to (1) the Dow Jones U.S. Real Estate Office Index (“DJ Office Index”) and five)(2) a custom Northeast Peer Group index comprised of six other companies with office real estate portfolios concentrated in the Northeast United States. We included this Northeast Peer Group index in order to act asmore closely link a retention deviceportion of the LTPP to our TSR performance relative to companies that are most comparable to us and provide a strong incentivethat operate in similar markets.

Vesting of the LTPP units is generally subject to continued employment with us, and satisfaction of the performance hurdles.

The following tables describe the structure of the 2023 LTPP granted to our Senior Executives for 2022 performance, with payouts between performance levels subject to straight-line interpolation. As of December 31, 2023, based on our one-year TSR relative to the executives to increase shareholder value long after they performedDJ Office Index and the services for whichNortheast Peer Group index, our performance would have placed us in the 93rd Percentile and 64th Percentile, respectively.

Dow Jones U.S. Real Estate Office Index Relative TSR Component (25% of Total Award)

| | | Level | | | | Percentage of Target

Amount Earned | | | | Relative TSR (Three Years) | | |

| | | Threshold | | | | | | 50% | | | | | 25th percentile of DJ Office Index companies | | |

| | | Target | | | | | | 100% | | | | | 50th percentile of DJ Office Index companies | | |

| | | Maximum | | | | | | 200% | | | | | 75th percentile or greater of DJ Office Index companies | | |

Northeast Peer Group Relative TSR Component (25% of Total Award)(1)

| | | Level | | | | Percentage of Target

Amount Earned | | | | Relative TSR (Three Years) | | |

| | | Threshold | | | | | | 50% | | | | | 33rd percentile of Northeast Peer Group companies | | |

| | | Target | | | | | | 100% | | | | | 50th percentile of Northeast Peer Group companies | | |

| | | Maximum | | | | | | 200% | | | | | 66th percentile or greater of Northeast Peer Group companies | | |

(1)

The Northeast Peer Group index is comprised of the following companies: Boston Properties, Inc., Brandywine Realty Trust, Empire State Realty Trust, Inc., JBG Smith Properies, Paramount Group, Inc. and SL Green Realty Corp.

| | | VORNADO REALTY TRUST | | | | 41 | | |

Operational Performance Component (50% of Total Award)

The operational component of our annual performance-based equity awards were initially granted. In particular, the awards provide for immediate cancellation if the executive voluntarily leaves or is terminated with cause (and, in either case, such person is no longer providing servicesmeasures our performance against four objective criteria over a one-year performance period, which remain subject to the Company or any of its affiliates as an employee, trustee or otherwise), excluding certain outstanding awards held by retirement eligible executives and employees above the age of 65 (or above the age of 60 with at least 20 years of service to the Company). Furthermore, we requireabsolute TSR modifier based on our executive officers (as defined in accordance with SEC rules, "Executives") to hold the equity received with respect to earned and vested awards for one additional year after they have vested.Our OPP is designed to provide compensation in a "pay for performance" structure. Awards under the OPP are a class of units (collectively referred to as "OPP Units") of the Company's operating partnership, Vornado Realty L.P., issued under our 2010 Plan. If the specificabsolute TSR performance objectives of the OPP are achieved, the earned OPP Units become convertible into Class A common units of the operating partnership (and ultimately into Shares) following vesting, and their value fluctuates with changes in the value of our Shares. If the performance objectives are not met, the OPP Units are cancelled. Generally, unvested OPP Units are forfeited if the executive leaves the Company, except that OPP Units vest automatically on death. OPP Units are intended to also provide recipients with better income tax attributes than grants of options. With regard to awards under our OPP, participants have the opportunity to earn compensation payable in the form of equity if and only if we outperform a predetermined TSR and/or outperform the market with respect to relative TSR over a three-year performance period, as determined at the end of the third year. Specifically, awards under our OPP may potentially be earned if the Company (i) achieves a TSR above that of the SNL US REIT Index (the "Index") over a three-year performance period (the "Relative Component"), and/or (ii) achieves a TSR level greater than 21% (over the three-year performance period) (the "Absolute Component"). To the extent awards would be earned under the Absolute Component but the Company underperforms the Index by more than a specified margin, such awards earned under the Absolute Component would be reduced (and potentially fully negated)described below. The FFO per Share, as adjusted, target was set in January 2023 based on our internal budget forecast for 2023 performance and the degree to whichESG targets were set in consultation with our senior management and sustainability team. The following table lists the Company underperformsfour performance criteria, the Index. In certain circumstances, if the Company outperforms the Index, but awards would not otherwise be earned under the applicable weightings and targets and actual 2023 performance in each of these categories.

![[MISSING IMAGE: tbl_award-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-045234/tbl_award-pn.jpg)

Absolute Component, awards may still be earnedModifiers

Awards under the Relative Component. Moreover,TSR Component of the 2023 LTPP are subject to reduction (but not increase) if the extent awardsCompany’s aggregate three-year TSR is less than 12%, with a maximum reduction of 30% of units that would otherwise be earned under the Relative TSR Component butif the Company fails to achieve at least a 3% per annumCompany’s TSR is negative over the three-year measurement period. As of December 31, 2023, our one-year absolute TSR level (6% for years priorperformance would have resulted in no downward reduction.

Awards under the Operational Performance Component of the 2023 LTPP are subject to 2016)reduction (but not increase) if the Company’s aggregate three-year TSR is less than 21%, such awardswith a maximum reduction of 30% of LTPP Units that would otherwise be earned under the RelativeOperational Performance Component would be reduced based onif the Company'sCompany’s TSR is negative over the three-year measurement period. As of December 31, 2023, our one-year absolute TSR performance withwould have resulted in no awards being earned in the event the Company's TSR during the applicable measurement period is 0% or negative, irrespective of the degree to which we may outperform the Index. downward reduction.

Post-Vesting Holding Period

If the designated performance objectives are achieved, OPP Unitsawards earned under the 2022 and 2023 LTPPs will vest 50% on the third anniversary of the grant date and 50% on the fourth anniversary of the grant date. The Chief Executive Officer is required to hold any earned and vested awards for three years following each such vesting date and all other award recipients are also subjectrequired to time-basedhold such awards for one year following each such vesting requirements. This creates, indate. Dividends on awards granted under the aggregate, up to a five-year retention period (plus the additional one-year hold period for Executives) with respect to participants in the OPP. Even after achieving the performance thresholds,LTPPs accrue during the remaining two years until full vesting (plus the additional one-year hold period for Executives), holders will continue to bear the same Share price and total return risk as our shareholders and be subject to the same "book-up" requirements as apply to Restricted Units and which are described below. Share dividend payments on awards issued accrue during theapplicable performance period and are paid to participants if and only ifto the extent that awards are ultimately earned based on the achievement of the designated performance objectives. Furthermore, for

In designing our LTPPs, we carefully selected performance criteria across important financial and TSR goals and we also incorporated ESG goals, demonstrating the

2016 OPP, ifemphasis that the

maximum award is earned (through any combination of the RelativeCompany places on ESG matters and

Absolute Components), the number of units actually awarded will be based on the Share price which cause the award to be fully earned. In prior years, the number of units actually earned was based on the highest 30-day average of the Share price achieved during a 120-day measurement period preceding the end of the three-year performance period.

| | | | | | | | | | |

| | | 42 | | | | | | | | |

2016 PROXY STATEMENT | | | | VORNADO REALTY TRUST | | | | 31 | | |

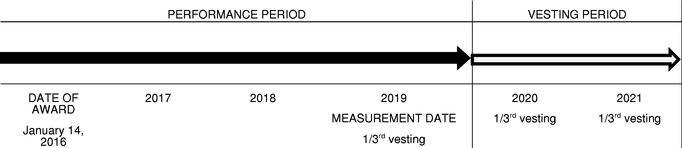

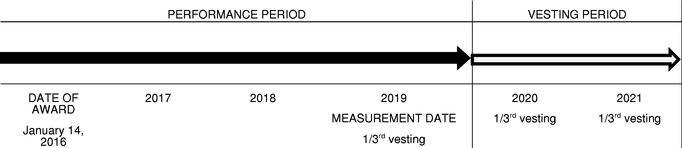

The following charts show some of the key components of our awards of OPP Units and, for illustration purposes only (and not as a projection of actual performance), present our most recent awards (made in 2016) as if they had been fully earned at January 10, 2019.

Earning and Vesting of OPP Awards

In addition, senior executive officers, including all NEOs, are required to hold their earned and vested OPP Units for one year following vesting.

Allocation of Wealth Created

On an absolute total shareholder return basis, our 2016 OPP is designed to award management with equity at the rate of 2% for every dollar of shareholder value created after returning the first 21% of value created to shareholders over a three-year performance period subject to a $50 million cap (if the full amount of the authorized OPP pool is actually awarded). While the earning of OPP awards not only requires performance under the Absolute Component, but also the Relative Component, for presentation purposes the table below is simplified to present only the results derived under the Absolute Component. Using this simplified format, the table below illustrates the rate at which OPP unitholders will share in the increases in shareholder value above the OPP initial share price along with shareholders and other unitholders.

Growth in TSR

| | | | | | | | | | |

Participation Percentage

in Shareholder Value

Creation under Terms of

the 2016 OPP for:

| | 0% to 21%

| | 21% to 35%

| | Above 35%

| |

|---|

| | | | | | | | | | | |

Shareholders and unit holders | | | 100 | % | | 98 | % | | 100 | % |

OPP Unitholders | | | 0 | % | | 2 | % | | 0 | % |

| | | | | | | | | | | |

Stock Options. None of our Named Executive Officers (or any other participant in our OPP) was awarded stock options for 2015, 2014 or 2013 performance. The most recent option award to such executives was in 2011 for 2010 performance. Executives who do not receive OPP awards may receive awards of stock options. Stock option awards issued under our 2010 Plan provide our executives the opportunity to purchase Shares at an exercise price determined on the date of grant. Historically, our stock option awards have either been in the form of at-the-money stock options, whereby the option exercise price is equal to the market price of Shares on the date of grant, or in the form of premium stock options, whereby the option exercise price is established at a level above the market price of Shares on the date of grant. In both instances, the market price of Shares must increase to a level above the option exercise price in order for the executives to achieve any value from their stock option awards. Generally, the stock options vest and become exercisable in equal annual installments over a four- or five-year period beginning one year after the date of grant, and remain exercisable for a period of ten years from the date of grant. Our 2010 Plan (i) prohibits the granting of in-the-money stock options and (ii) prohibits, without shareholder approval, the repricing of outstanding stock options that have fallen out of the money. Recipients of stock options do not receive any dividends paid on Shares on their outstanding option awards.

| | | | | | | | | | |

| | | | | | | | | | |

| | 32 | | | | VORNADO REALTY TRUST | | | | 20162024 PROXY STATEMENT |

| | | | | | | | | | |

aligning Senior Executives’ compensation with such priorities. We also included a range of performance periods that, taken together, aim to account for the complexities of operating our business over both the short-term and the long-term.

Restricted Shares and Units. "Restricted shares"

“Restricted units” (which we also refer to as “LTIPs”) are grants of Shares issuedlimited partnership interests in the Operating Partnership under our 2010 Plan thatOmnibus Plans. These units generally vest in three or four equal annual installments beginning approximately one year after the grant date. "Restricted units" are grants of limited partnership interestsand include a two-year holding requirement. The restricted units granted in Vornado Realty L.P., our operating partnership through which we conduct substantially all of our business. These units also generallyJune 2023, however, vest in three or fourtwo equal annual installments beginning approximately one year afteron the 3rd and 4th anniversaries of the grant date, andrespectively, subject to the recipient’s continued employment with the Company as of such date, with each vesting tranche subject to an additional one-year post vesting transfer restriction.